The 2025 Seraph Automotive Manufacturing Report highlights three critical themes shaping the industry: tariffs, talent, and technology. Based on industry data and Seraph’s Auto Leaders Survey, the report outlines key challenges, economic pressures, and strategic responses for OEMs and suppliers in North America and Europe.

Strategic Takeaways

- OEMs and suppliers must prepare for tariff impacts: Reviewing footprint strategies and supply chain risk mitigation is essential.

- Cost-cutting and operational efficiency will be a priority, with a focus on reducing scrap, downtime, and logistics costs.

- EV investment strategies need recalibration, as regulatory changes and shifting consumer demand reshape long-term viability.

- Talent development is critical, requiring apprenticeship programs, workforce training, and hiring strategies for reshoring initiatives.

Key Trends in Automotive Manufacturing

1. Volumes & Financials

- Demand remains weak, impacting factory utilization and financial performance.

- Publicly traded suppliers are seeing stronger margins than OEMs for the first time in four years, largely due to improved cost structures and negotiation power.

- OEMs continue to struggle with low volumes, program delays, and a reliance on luxury and high-margin vehicles to sustain profitability.

- Consumers resist high prices, forcing increased incentives such as 0% APR financing and rebates to boost sales.

- Inventory levels have surged to 3.15 million vehicles, nearly triple 2022 levels, causing downward pricing pressure.

2. Tariffs & Geopolitics

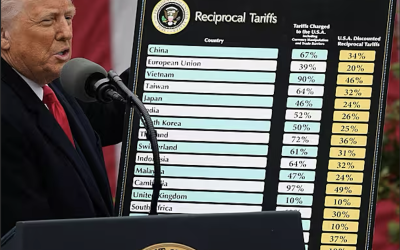

- The incoming Trump administration is expected to introduce sweeping tariffs, particularly on China, Mexico, and Canada. At the time of publishing, Trump has threatened (latest tariff updates will be at Seraph’s tariff tracker here):

- China: 60-100% tariffs on all imports, 100-200% on vehicles, aiming to protect U.S. manufacturing.

- Mexico & Canada: 25% tariffs if border issues persist.

- Other trade allies: 10-20% tariffs across industries.

- Tax incentives for reshoring: A 15% corporate tax rate for U.S. manufacturers and 20% for domestic companies.

- European OEMs face pressure as Chinese automakers increase market share with competitive pricing and strong product quality.

- Supply chain disruptions remain a concern, with trade wars impacting component sourcing and potential production shifts.

3. Talent & Workforce Challenges

- Talent shortages dominate strategic planning for 2025.

- Relocations and consolidations are forcing companies to navigate hiring difficulties, wage inflation, and skill gaps. We believe tariffs and resilience objectives will require companies to develop talent cultivation programs as skilled trades are already in short supply.

- Manufacturing hubs like Mexico are struggling to meet skilled labor demand, with concerns over worker retention and availability.

- Plant closures and consolidations are expected to rise as companies optimize footprints to offset demand reductions and uncertainty. .

4. Technology & EV Transition

- EV infrastructure remains a bottleneck: Public fast-charging networks are inadequate outside of major cities.

- We analyzed county level data and determined EV adoption rates are mostly driven by three factors (see the report for deeper analysis):

- Cost (household income, tax credits)

- Convenience (charging density)

- Politics (Democratic-leaning counties adopt EVs at higher rates)

- Tesla remains the only Western EV OEM profitable without subsidies, while other automakers struggle to achieve cost parity, pressure through reduced subsidy or tariffs will further exacerbate this price differential due to the relative concentration of Tesla’s assembly and supply chains in the U.S.

- China leads in charging infrastructure, adding 734,000 public chargers in 2024 alone, while the U.S. remains fragmented,

- Trump’s policies may cut federal EV incentives, further slowing adoption and impacting EV-focused suppliers.

For more insights, visit Seraph.com or contact meet@seraph.com.

Seraph is pleased to share the webinar of our quarterly industry report—an insightful discussion about the prevailing trends shaping the automotive sector. During this webinar, Seraph’s Founder and CEO Ambrose Conroy and VP of Client Development Jay Butler, and more of the Seraph team provide an outline of the report, accompanied by engaging interactions with fellow leaders who participated in the discussion.