As the COVID-19 virus worked its way around the globe we’ve all learned about R0 values, global ventilator capacity, face masks, sneeze velocity and a myriad of other obscure facts.

The real lesson from the current situation is not our enhanced knowledge of epidemiology or virology, but rather in the vivid demonstration how disconnects between the time required to synthesize information vs the speed of global communication can interact with market perceptions to produce dramatic and abrupt shifts in behavior.

Organizational Behavior – Perception vs. Reality

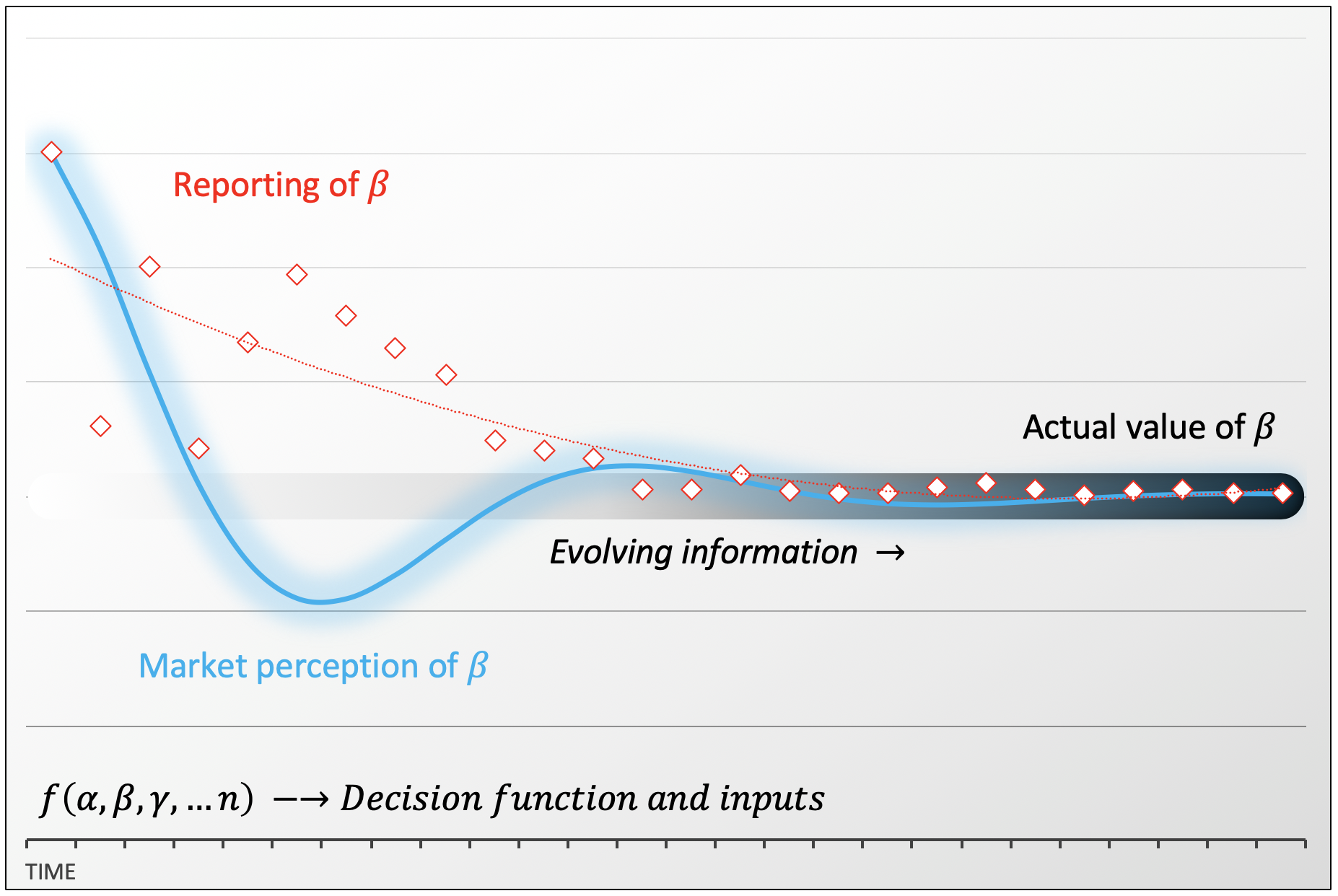

The immediate driver of decisions made by consumers, businesses, governments, etc. is perception. Over the course of time perception may be bolstered or eroded by the underlying reality. If the perception is supported by reality, the behavior can be expected to solidify into a long-term trend. Conversely, unsupported perceptions are likely to be shorter-term fads. Take for example a product people purchase for its perceived reliability. If warranty and return information do not support the assumed reliability and consumers become aware, perception will eventually evolve, and this driver will cease to influence the purchase decision. Understanding perception and possible gaps from reality is necessary to stay ahead of evolving trends.

The Evolution of Information

I had an influential boss who would often say “Facts are stubborn.” It was an admonishment to take time, see the reality for yourself, collect data and use it to drive your decision making. At Seraph we have refined this to:

“Numbers → Data → Information”

- A number is just a symbolic representation of something. It has no intrinsic relevance until validated to represent something real.

- A validated number becomes data. A string of data is also intrinsically irrelevant until put into appropriate context creating information.

- Information is what we need to guide our decision making. The process of vetting and analysis required to derive information takes time.

Math ≠ Information

Using unvalidated numbers, or even arranging data in an irrelevant way inside an impressive looking jumble of symbols and jargon, does not sanctify or imbue credibility to the resulting answer. If you see or hear the popular saying “It’s just math”, look and listen very closely. Rarely, other than academic exams, does the “math” result in an absolute answer. Instead, for problems of real-world complexity, math usually presents a range of outcome probabilities, built on a construct of assumptions both known and estimated. Understanding probabilities and assumptions is critical to wrenching information from math.

Decision Making in an Imperfect World

All decisions are framed by consequences and time; what are the possible consequences of the decision, and when are those consequences expected to manifest. The time available to make the decision vs. the time it takes for information to evolve is rarely coincident. When faced with a consequence of dire or even existential magnitude, timeliness of the decision is paramount. The most difficult situation a leader encounters involves, dire consequences, a ticking clock, bereft of information. To minimize the need to make decisions lacking or absent information, speed in deriving information is essential.

Communication Gone Wild

The world has built an incredible, interlinked communication system to disseminate numbers, data and information with near-instantaneous speed. Time sensitivity in publishing content often out-strips the time required for information to develop. In addition, delivery of information is not necessarily the motivator of media sites. The economic motivation of all news aggregators, social media sites, websites in general and the resulting relevance in driving perception, is the same: The click. The click generates revenue for the platform and determines relevance in market influence. The extent which these sources deliver information is correlated to the consumers understanding of what information is, and their desire to acquire. If consumers don’t know what information is, and their “clicking” is not driven by a desire to acquire information, any information conveyed by these sources is coincidental in the aggregate. This hyper-charged network, not primarily motivated to deliver information, can drive large scale, consensus change in perception which may diverge radically from the underlying reality.

This is the primary lesson from the COVID situation. Faced with an emerging, possibly existential threat, and having only numbers, a smattering of data and very little information available, the world united in support of measures rarely tried individually and never collectively. They are often called government-imposed lockdowns as if a fiat, but polling suggests the governments are only implementing actions which enjoy widespread popular support. The evolving understanding of the virus will ultimately validate some perceptions and invalidate others which may lead to an equally rapid modification of future behaviors and actions when faced with similar circumstances. The ultimate “score” of rightness or wrongness is irrelevant. There will always be perceptions formed and decisions made in the absence of perfect information. The speed and scale of the behavior shifts recently demonstrated are the salient point.

Consumer behaviors, government regulations, trade tariffs can all be impacted by this chaotic interplay of perception and reality. In response, successful organizations will have resources and analytics designed to help foresee these shifts and will be structured in a way to allow rapid redeployment in the response to unforeseen eventualities.

Secure your own sources of information

Information is not readily available from today’s mass media sources. In addition, information does not self-organize; it requires energy and resources to produce. Whether a small in-house group or a relationship with a trusted outside partner, securing your own source of intellectual capital is critical to understanding complex markets and predicting future trends.

Track perception; measure reality

After identifying the perceptions driving the behavior in question, it’s important to continuously monitor them. Concurrent with tracking the perceptions, measure the underlying objective foundations on which they are based. When large gaps are identified it is even more critical to look for movements and momentum in the perception trends. The size of the gap will be proportional to the upcoming adjustment and the market awareness will determine the speed of the change.

Lower structural inertia; bias towards flexibility

No analysis is omniscient and unexpected events will always arise. Flexibility in all your assets, people, capital, and extended enterprise partners are key in adapting and surviving. Migrate to project-based organizational structures vs hierarchical. Implement and master the use of today’s collaborative tools so geography is not an impediment to deploying the right skills to the mission. Design products to minimize dedicated capital investment. Shorten supply chains. With people, equipment and your supply partners, agility is vital, and the inherent risk of rigidity needs to be appropriately weighted against short term cost optimization.

The dynamic nature of today’s market is not one-sided bearing only risk, but rather amplifies the eternal balance of greater risk creating the opportunity for commiserate rewards. It is much like a modern fighter jet. Both are inherently unstable, but with the right analysis predicting and providing real-time control feedback, they are capable of remarkable agility.

Jeff Jaisle jjaisle@seraph.com

Jeff is an Engagement Manager at Seraph and leads the Production.Net software division, which provides actionable data capture and visualization for manufacturing firms. He has over 25 years experience in the Automotive and Manufacturing space as the previous COO of Brose North American Operations, and VP of Operations for both Benteler Automotive and JAC Products.

About Seraph:

Seraph’s team of operational managers and senior consultants intercede on our client’s’ behalf to fix a crisis that is putting the business at immediate risk, turnaround a situation that is damaging the bottom line or restructuring to improve the balance sheet. Seraph has successfully delivered projects in the following regions: The Americas, Europe, China, and India. Seraph’s Industry Expertise Includes Aerospace, Automotive, Energy Infrastructure, Healthcare, and Medical Devices. Through our other operating companies, we are continually looking for distressed situations where we can put our expertise and capital to work to create value.