Force Majeure Disclaimer: Seraph is not a Law firm. We write from an Operations Strategy and Execution perspective. Please utilize appropriate legal counsel.

Covid-19 had a drastic impact on Spring 2020. Businesses were ordered closed, some workers became sick, and production targets fluctuated substantially. First in China, then Europe and the U.S. the initial patterns were similar. Extended closure, delayed restarts followed by cautious reopening, and ramping production broadly characterized the automotive industry.

Now operational and supplier health varies significantly by company. In this unusual situation, some suppliers considered the possibility of force majeure to prevent further losses and potential financial consequences due to contractual breaches.

What is Force Majeure?

“This breach of contract was out of our control”

Force Majeure clauses provide contracting parties with a defense against stipulated liabilities if they are unable to fulfill their underlying obligations due to situations that are out of their scope of control. Examples of these situations are natural disasters, wars and pandemics. For manufacturing, an example situation that may be eligible for force majeure is the delay in production or delivery due to legal shutdown orders. As with other contractual matters, force majeure provisions rely on a strict set of pre-defined conditions. Once conditions are known and understood, there is an expectation that companies will plan accordingly, for this reason, contracts inked during the pandemic are unlikely to be eligible for force majeure.

Key drivers of production capability

Decreased industry revenues impact all stages of supply chain. Each plant experienced a slightly different situation based on:

- Diversity and location of suppliers, across national and regional borders

- Case rates of the local area and timing of infection waves

- Effectiveness of regional public health officials to record and disseminate real-time information

- State-level testing resources

- Government policy

Although each management team is dealt a different set of circumstances, even businesses in similar situations can have widely differing beliefs as to what is within their control. As the pandemic spread globally, many manufactures opened their existing management toolkit to find it empty. Classic supplier quality management is built on in-person interaction, people getting in cars or on planes to go and see the problems directly. Although being on-site is a proven way to get high-fidelity answers with low latency, implementing digital production monitoring tools and sharing KPI data transparently can allow customers and suppliers to work together to solve problems before a crisis is created.

Customer approach

Savvy customers will distinguish management issues from true COVID issues by knowing their contract scope to the letter and keeping complete records of communications and warnings received. The larger the organization, the greater number of firms to compare against a languishing supplier. Excuses and poor communication will exacerbate the issue and leave little room for a legal department to build a force majeure defense.

Supplier approach

Supplier teams should continue to improve upon their operational risk mitigation approach and clearly document steps taken such as:

- Mask, testing, and sanitization strategies

- Installed barriers, and increased ventilation

- Securing alternative manufacturing lines in different locations or finding alternative suppliers or business partners

- Deployment of digital resources and reasonable efforts made to digitize work processes

- Adopting work from home tools

- Rolling on cloud-based production and performance monitoring systems

Operations teams can play a critical role in supporting the legal and commercial side of the business. Well implemented, documented, and transparently communicated measures can determine success. Notice of a potential breach

Working together and taking a long view

Manufacturing is bound by constraints that many other industries do not face. Principally, the need for a significant in-person labor force. The challenge of running a capital-intensive business with profit margins thin from decades of competition should not be understated. To avoid bankruptcy and severe negative financial consequences, a premium has been paid for the COVID 19 impacted labor force. These premiums are unsustainable. As a result, OEMs and suppliers are in a strained relationship from a commercial and supply standpoint.

As the industry migrates away from the internal combustion engine, consolidation and reconfiguring of the supply base are expected. Even when applicable explicit and well-defined force majeure conditions were expressly written in the contracts, every effort should be made to safely fulfill contractual obligations. Well-managed suppliers can bank reputational goodwill they may need to draw in uncertain times ahead. Aggressively pursuing legal action or making loose claims might result in serious reputational consequences.

Building a stronger business for the future

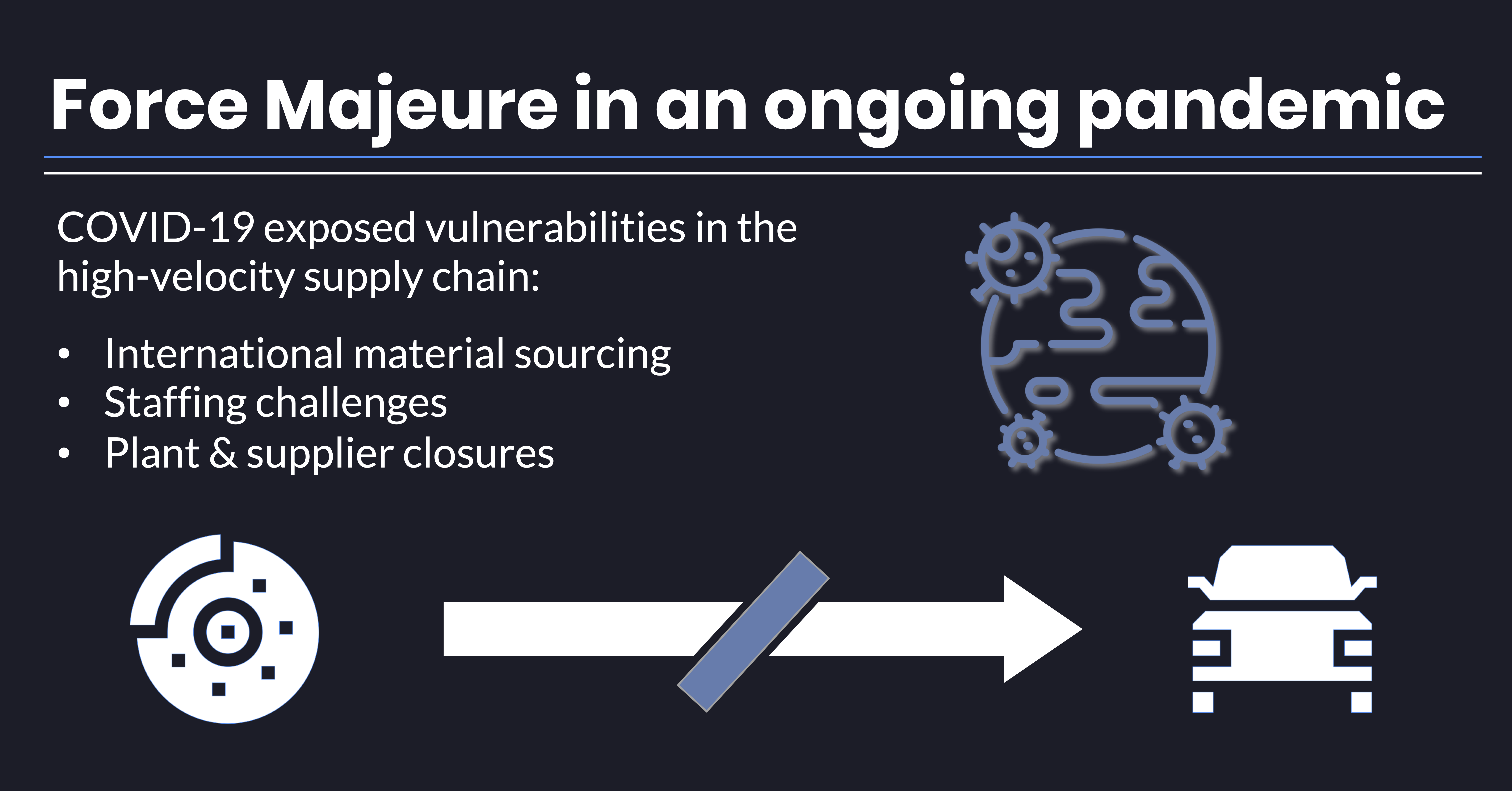

COVID-19 caught most manufacturers off-guard. The pandemic has been a pressure test for current manufacturing methodologies, purchasing strategies, and management systems. While force majeure can be claimed in many disruptions that occurred around COVID, there is a school of thought that says this should have been expected and therefore is not a force majeure eligible event.

The fully optimized, high-velocity supply chains that many firms depend on today turned into one of the biggest challenges with COVID-19. We expect to see a higher degree of risk quantification in the future and customers may try to argue that their suppliers should have already been doing more risk mitigation in sourcing decisions.

As with all things there are many sides to any argument, we at Seraph advise you to consult with your in-house counsel or firms’ lawyers before making a force majeure argument.

About Seraph:

Seraph’s team of operational managers and senior consultants intercede on our client’s’ behalf to fix crises putting businesses at immediate risk, turnaround situations damaging the bottom line, and restructure operations to improve the balance sheet. Seraph has successfully delivered projects in the Americas, Europe, China, and India. Seraph’s industry expertise includes Aerospace, Automotive, Energy Infrastructure, Healthcare, and Medical Devices. Through our other operating companies, we are continually looking for distressed situations where we can put our expertise and capital to work to create value.