The COVID-19 pandemic highlighted the United States’ dependence on a mostly foreign medical supply chain. With shortages of PPE and generic medicines, the federal government has struggled to meet the unprecedented increase in demand for medical goods. Now, to reduce dependence on other countries and ensure higher self-sufficiency, the US is making moves to onshore the production of drugs.

The US pharmaceutical supply chain is dependent on overseas production

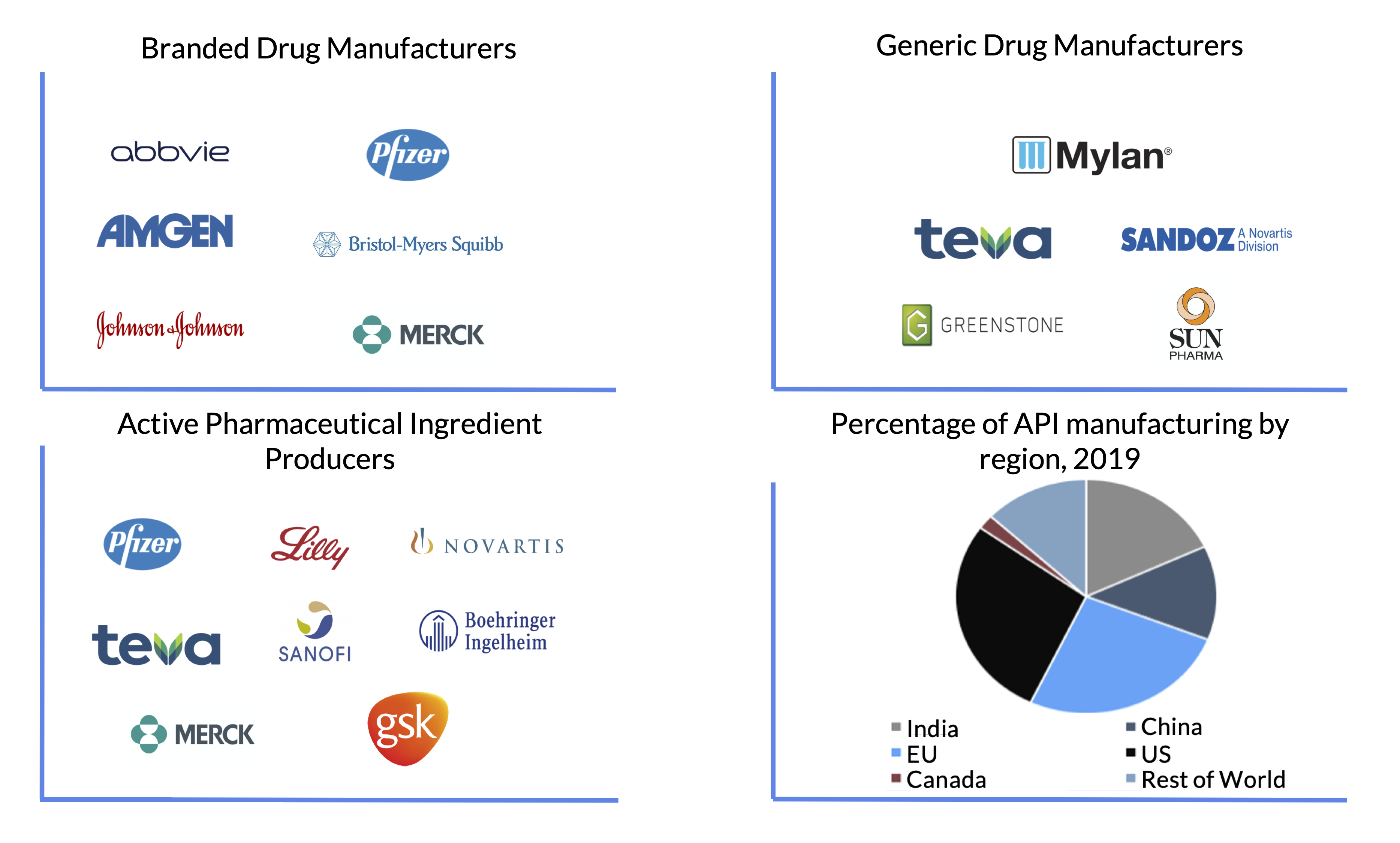

Dr. Janet Woodcock, Director of the Center for Drug Evaluation and Research (CDER) at the Food and Drug Administration (FDA), in her congressional testimonial, stated, “the United States, through its investment in biomedical research, has become a world leader in drug discovery and development but is no longer in the forefront of drug manufacturing…in recent decades, drug manufacturing has gradually moved out of the United States. This is particularly true for manufacturers of active pharmaceutical ingredients (APIs), the actual drugs that are then formulated into tablets, capsules, injections, etc.”

The Active Pharmaceutical Ingredient (API) is the biologically active component of a drug product and is one of the most crucial components of the pharmaceutical supply chain. Today, the US gets 72% of its API supply from abroad. While the European Union is the largest supplier of APIs, accounting for 26% of the US market, India and China also have garnered rapid growth in the past few years, rising to 18% and 13% of the US API market respectively. At the same time, China has also achieved unparalleled dominance in the supply of chemical raw materials (precursor to APIs) to the US, while India has boosted their production of generic medicines to command 40% of the generic pharmaceutical market in the US. This shift in production has made India and China an almost irreplaceable part of the US pharmaceutical supply chain.

This manufacturing shift away from the US can be mostly attributed to the strategic decisions made by western drug companies and contract development and manufacturing organizations (CDMOs), who sought to cut costs by outsourcing labor and avoiding the environmental risks associated with the handling of highly corrosive chemicals used to make drugs. Now, the chemical raw material manufacturing industry remains highly unregulated and saturated in Asia, allowing API manufacturers to take advantage of the heavy competition and source materials at cheap rates, with COGS typically accounting for less than 50% of sales. Reports suggest that as compared to the Western markets, China and India also enjoy a strong labor cost advantage, thus enabling API manufacturing to be 30%-40% cheaper than their western counterparts.

Federally funded US pharmaceutical manufacturing programs look to expand domestic capacity

In the past few months, to incentivize stateside manufacturing, the federal government has ramped up activity in the medical industry and has funded multiple pharmaceutical companies. Amongst them, a few key deals include: Phlow, a Virginia-based drug manufacturing company, which received federal government funding of $354 million for the creation of essential generic medicines in the US; Paratek Pharmaceuticals received funding of $285 million to build an onshore supply chain from scratch for their antibiotic Nuzyra; Emergent BioSolutions received $628 million to support vaccine production in the US, and a host of other deals for companies working on a COVID-19 vaccine, under operation Warp Speed.

The federal government has also been contemplating the implementation of protectionist policies for medical products. In April, White House economic adviser Peter Navarro proposed a “Buy American” executive order for the pharmaceutical industry. If implemented, this policy would require government agencies to purchase only American-made medical products. However, this policy has met with retaliation from the Pharmaceutical Research and Manufacturers of America (PhRMA), the pharmaceutical industry’s biggest lobbying group, which has pushed back against Congressional support for a displacement of the supply chain. A PhRMA spokesperson in a statement said “While we support efforts to foster more manufacturing in the United States, moving all manufacturing here (to the US) is impractical and likely not feasible.”

Limited domestic access to raw materials undermines US API independence

PhRMA’s disagreement is based on a simple fundamental: onshoring pharmaceutical production would increase the costs of producing drugs exorbitantly and would disturb the balance of the global pharmaceutical supply chain. Since a large majority of pharmaceutical manufacturing is labor-intensive and relies on highly skilled workers, the manufacturing processes would be vulnerable to soaking up the limited available highly skilled labor force in the US, as compared to existing pools in Asia. Historically, workers in this industry require intensive long periods of training. Labor turnover has been high due to challenging work environments including working protocols in clean rooms and constant use of PPE materials. Hence, a shift of this magnitude would require time and increased mobilization of the skilled labor section in the US.

Another segment of US API producers, under the umbrella of the Bulk Pharmaceuticals Task Force (BPTF), suggests that the whole supply chain must be considered before the government decides to encourage a massive displacement of the supply chain. John DiLoreto, executive director of the BPTF, noted, “There are a lot of raw materials that aren’t available from the US; they are only available from China. This makes it difficult to suggest that bringing all the API manufacturing back to the US and Europe solves the problem. It doesn’t if we can’t control the whole supply chain.”

As the number of COVID-19 cases rises in the US, the federal government faces an uphill task in procuring enough drug supply to meet the domestic demand. While the move towards reshoring pharmaceutical manufacturing to the US has received significant financial backing from the federal government, the economics and fundamentals of the supply chain suggest that drastic changes in the near term look highly unlikely; yet, the dynamics of the long term remain to be seen.

About Seraph:

Seraph’s team of operational managers and senior consultants intercede on our client’s’ behalf to fix crises putting businesses at immediate risk, turnaround situations damaging the bottom line, and restructure operations to improve the balance sheet. Seraph has successfully delivered projects in the Americas, Europe, China, and India. Seraph’s industry expertise includes Aerospace, Automotive, Energy Infrastructure, Healthcare, and Medical Devices. Through our other operating companies, we are continually looking for distressed situations where we can put our expertise and capital to work to create value.